If you’re starting a business, you’ll need to understand accounting principles to judge your organization’s health and progress towards its goals.

Businesses are built on transactions. The basics of accounting begin with a system for recording and reporting your transactions. Even if you plan to outsource accounting and bookkeeping, you need to be able to read and understand your financial reports and that means understanding a few basic business setup and accounting principles.

Let’s begin with a series of questions:

1. What kind of business do you have?

Is it a service, merchandising, manufacturing, or information business?

Some companies are hybrids of two or more types: a meal shake business that imports its own raw materials for processing is a manufacturer, but when it sells the shakes, it’s a merchandiser. If it has a physical location, it becomes a service when the shake is prepared and given to a customer. And if it offers classes on how to sell shakes or smoothies, it’s an information business.

Your business type determines the transactions that will make up the majority of your accounting.

Next, what is the ownership structure? There are different bookkeeping and banking requirements for sole proprietorships, partnerships, corporations, limited liability corporations (LLCs), and cooperatives. Learn more about the differences.

2. Do you have business licenses and permits?

You’ll need these to open a business bank account and be able to report your taxes properly. The documents you need vary depending on the type of business and location of operations.

3. Do you have a separate business bank account?

Most ownership structures require that your business have a separate account. But it’s recommended for every business you don’t want your personal transactions co-mingling with your business ones if you can help it.

4. Will you have employees?

If not, you’ll have a much easier accounting process. But if you plan to have employees, you’ll need to set up procedures for withholding taxes.

Even if it’s just you for now, you’ll probably still hire contractors for particular projects. Contractors who are paid above a certain amount per year in the U.S. must be sent a 1099, so be sure to:

- Track who you’ve paid and how much you’ve paid them.

- Get a W-9 form from each contractor.

- Keep current addresses on file for everyone you hire.

5. Do you have accounting software?

If you expect to have hundreds or thousands of transactions per month, you’re going to want accounting software like QuickBooks or FreshBooks. Businesses with fewer transactions can get away with using an Excel spreadsheet, but a high-transaction business won’t be able to keep up with manual entries.

Accounting software automates most of the essential processes and takes a lot of the work out of your hands. It records, stores, and retrieves transaction data and uses it to produce financial statements and reports. Your accounting software can also create invoices and write checks.

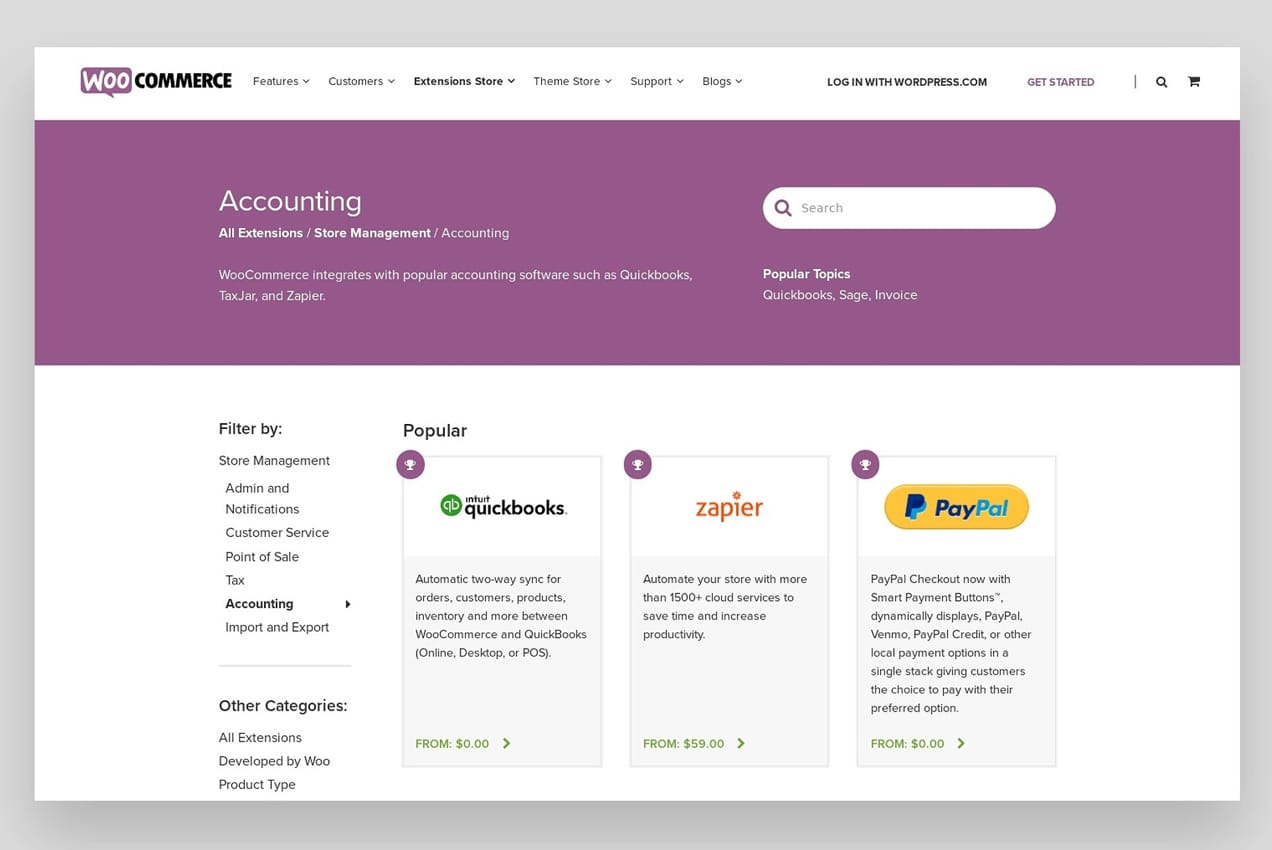

If you decide to use accounting software, you can sync your store data with QuickBooks Sync for WooCommerce or WooCommerce FreshBooks.

With these basic questions resolved and your business foundations in place, you’re ready for the next stage in the accounting process.

First, let’s be clear about some terms.

Transactions

In accounting terminology, a transaction happens any time money is given, received, or asked for by a business or vendor.

A transaction could be any of the following:

- Money the owner invests in the business.

- Revenue from sales.

- Invoices.

- Expenses like wages, marketing, travel, and building costs.

- Assets purchased, such as vehicles, office equipment, property, or materials.

A single transaction can have multiple components. When you pay an hourly employee, for example, you have to know the amount of time they worked, their gross wages, tax deductions, and net pay. Your accounting software can perform all of these tasks.

Debits and credits

All transactions are tracked by a system of debits and credits. The best way to understand it is with this basic accounting equation:

Assets = Liabilities + Equity (Owner’s or Corporation’s)

A debit is added to the left side of the equation. A credit is added to the right.

As a simple example, if you make a sale for $500, that $500 gets debited, meaning it gets added to your business assets. And it also gets credited as Owner’s Equity in the form of income. Whenever something gets debited, something else must be credited, because this keeps the equation balanced.

That’s a vastly simplified version of something we could spend several books talking about, but it gives you a basic idea of what your accounting software is doing when you enter transactions.

Cash method and accrual method accounting

There are two basic methods of accounting – the cash method and the accrual method. The accrual method is the more common one, and depending on the size and nature of your business, may be required by law.

The basic difference between the methods is when a transaction is recognized.

In cash accounting, a transaction is recognized when actual money has changed hands. In accrual accounting, the transaction is recognized when the work has been completed and the invoice sent. Suppose you place an order for a fresh supply of office paper in January and put it on your business credit card. You receive the office paper immediately, but you don’t actually pay for it until February, when your credit card statement arrives.

In accrual accounting, the transaction happens the moment you buy the paper. You take the receipt, store it in your file system, and record the expense. It is an expense for January, even though you don’t pay for it until the next one.

In cash accounting, the transaction happens when you pay the bill. That’s when actual money changes hands. Thus, it is a February expense, even though you received the paper in January.

Income operates the same way. If you send an invoice to a customer in May and they don’t pay it until July, the transaction is recorded in May using the accrual method, but in July using the cash method.

Accrual accounting is the preferred method, especially for larger businesses. It gives you a clearer picture of your cost of goods or services sold each month. If you buy paper in August, that paper was part of the cost of running your business – in August, not when you actually get around to paying the bill. If you make a sale in May, then you made the sale in May, not in July when the customer gets around to sending you the money.

Using the accrual method, you can reconcile costs of doing business each month, so you can see which months produced the highest margins. Calculate margins with this equation:

Margin = (Revenue – Cost of Goods) / Revenue

(To simplify this process, WooCommerce has an extension that calculates your cost of goods so you can compute the cost of each specific product you sell, a category of products, or all of your products for any time period you select.)

The three primary financial statements

With your accounting systems and software in place and your transaction data entered, you’ll be able to prepare your three basic financial statements: the income statement (also known as the “profit and loss statement” or P&L), the balance sheet, and the statement of cash flows.

Income statement

The income statement reports profit earned over a specified period of time, such as a month. This profit is what people refer to when they use the term “bottom line.” Your profit is your net income. Or, if you lost money during that time period, your net loss.

In simple terms, profit is calculated by subtracting expenses from revenue. This reinforces the reason to use the accrual accounting method. If you use the cash method, you won’t be able to see as clearly what you actually earned and spent during that specific month of business.

Balance sheet

Your balance sheet reports your assets, liabilities, and equity at a specific point in time, typically at the end of a month, quarter, or year. It is a snapshot of your financial health.

Assets are things owned that have value, such as cash, supplies, equipment, vehicles, property, inventory, and accounts receivable. An “account receivable” is the term for money you are owed but haven’t been paid yet.

Liabilities are things you owe, such as loans, interest payments, wages, and anything on credit. Liabilities are usually termed as “payables.”

If you look back at the basic accounting equation listed earlier, you’ll see that equity is simply the difference between assets and liabilities. Subtract liabilities from assets, and you have what’s called the “book value,” or equity, of your business.

Statement of cash flows

This is simply a statement showing how your cash on hand has changed during a given time period.

All three of these basic financial statements can be quickly produced by your accounting software, as long as you’ve been diligent about entering your transaction data. If you don’t have time for that, you may want to consider hiring a bookkeeper.

Two final accounting basics for small businesses

1. Keep all receipts, invoices, and payment records

The Reliability Principle of accounting says that only transactions with supporting documentation should be recorded. If you don’t have records of a transaction, you can’t count it as income or an expense, and that messes up your books. If you tried to claim a tax deduction for an expense you have no proof you ever paid for, that could be called tax fraud.

So keep physical receipts in a file. Or take photos of them and store them digitally. Keep all emailed invoices and receipts in a separate email folder too, not just your general inbox.

2. Know your tax requirements

Tax requirements vary dramatically depending on the type of business and where it operates. You need to know about sales tax, import tax if you have any international transactions, tax withholding, paying estimated quarterly taxes, and any other taxes specific to your nation, state, province, city, or region.

Those taxes will figure into your accounting software and financial statements. It is always recommended to consult with a tax professional to ensure you’re following the right procedures.

WooCommerce has accounting covered

WooCommerce understands the responsibility business owners have each day. Manually inputting transactions and creating financial reports can be time consuming, but accounting is an essential part of running a successful business.

To take the burden off of store owners, WooCommerce has a variety of extensions that automate key accounting processes. Visit this page for a full list of accounting extensions for WooCommerce stores.